Free payroll calculator 2023

2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings. FAQ Blog Calculators Students Logbook.

Payroll Template Free Employee Payroll Template For Excel

This Tax Return and Refund Estimator is currently based on 2022 tax tables.

. The maximum an employee will pay in 2022 is 911400. GetApp has the Tools you need to stay ahead of the competition. Heres a step-by-step guide to walk you through.

If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0455 of your gross. Ad Employee evaluation made easy. The standard FUTA tax rate is 6 so your max.

Prepare and e-File your. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Ad Compare This Years Top 5 Free Payroll Software.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. In 2022 earned income between 001 and 147000 is subject to this payroll taxApproximately 94 of working Americans earn less than the maximum taxable earnings cap the 147000. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

Or use any of these four Free W-4 tools later. Return filed in 2023 2021 return filed in 2022. Free salary hourly and more.

Computes federal and state tax withholding for. UK PAYE Tax Calculator 2022 2023. See where that hard-earned.

The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. Set up your evaluation process get feedback and more. 2022 Federal income tax withholding calculation.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary. 2022 Federal income tax withholding calculation. Ad Compare This Years Top 5 Free Payroll Software.

Louisiana paycheck calculator is a helpful tool for employers to use to calculate the amount of net pay they must withhold from an employees check. Free online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors. 2023 Paid Family Leave Payroll Deduction Calculator.

Ad See the Calculator Tools your competitors are already using - Start Now. How to calculate annual income. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Manage recruiting appraisal expenses leaves and attendance easily with Odoo. About the US Salary Calculator 202223. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings.

This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. See the results for Best payroll calculator in Suffern. For example if an employee earns 1500.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. It will be updated with 2023 tax year data as soon the data is available from the IRS.

ICalculator provides the most comprehensive free online US salary calculator with detailed breakdown and analysis of your salary including breakdown. 2023 Tax Calculator 01 March 2022 - 28 February 2023 Parameters. In 2023 the maximum.

2022 Federal income tax. Free Unbiased Reviews Top Picks. Subtract 12900 for Married otherwise.

Free online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors. It will be updated with 2023 tax year data as soon the data is available from the IRS. Employers can enter an.

Free Unbiased Reviews Top Picks. Small Business Low-Priced Payroll Service. Ad Compare This Years Top 5 Free Payroll Software.

The 2023 Calculator on this page is currently based on the latest IRS data. See where that hard-earned money goes - with UK income tax National Insurance student. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

Subtract 12900 for Married otherwise. 3 Months Free Trial. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates. Starting as Low as 6Month. As the IRS releases 2023 tax guidance we will update this tool.

Payroll calculator 2023 Kamis 08 September 2022 Edit. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Oudyzwzrnz7yum

Payroll Template Excel Get Free Excel Template

Business Operating Budget Template Operating Budget Template Operating Budget Template What To Know About I Budget Template Free Budget Template Budgeting

1

Construction Contract Agreement Template Google Docs Word Apple Pages Template Net Contract Template Construction Contract Contract Agreement

Grade Book Templates 13 Free Printable Doc Pdf Xlx Grade Book Grade Book Template Templates

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Templates Paying

Payroll Template Excel Get Free Excel Template

2022 Biweekly Payroll Calendar Template For Small Businesses Hourly Inc

My First Million By 16th October 2023 How To Get Money Credit Card App Business Travel Outfits

Salary

1

What S In Your Pantry Pantry Inventory Printable Checklist Pantry Inventory Pantry Inventory Printable Pantry Inventory Sheet

Free Virginia Payroll Calculator 2022 Va Tax Rates Onpay

1

Free Virginia Payroll Calculator 2022 Va Tax Rates Onpay

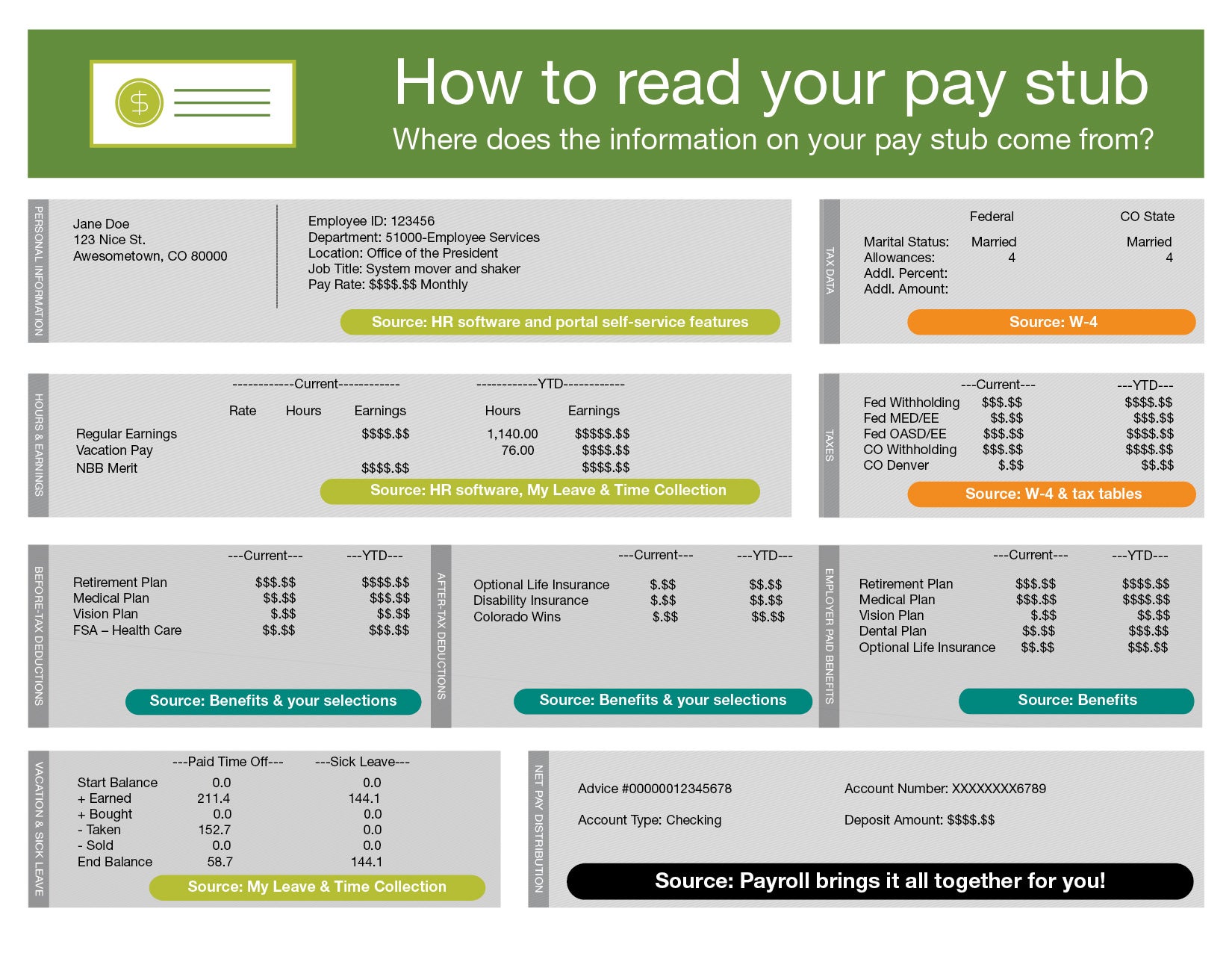

Paychecks University Of Colorado